The World Intellectual Property Organisation (WIPO) recently published a report: WIPO Technology Trends, Future of Transportation. The report provides a detailed review of technology trends across a range of transportation sectors, based upon a range of data sources (including patent filings). I provide my own review of the data below, with a focus on air transportation (e.g. airplanes, helicopters, drones, and vertical take-off and landing [VTOL] aircraft for travel and goods).

Patent family publication trends in air transportation in 2000-2023

Beginning with an overview of patent family publication data in the air transportation sphere, Figure 1 below (left) shows significant growth (Compound Annual Growth Rate [CAGR]) in the last ~10 years in particular. The publication of a patent family can generally be taken to indicate at least one invention for which a patent application was prepared and filed, in the ~18 months preceding the publication date. Whilst not a perfect science, the number of patent families publishing can be taken as an indicative representation of innovative activity in a given field, albeit with an ~18 month lag due to the delayed publication of patent applications. A plateau of the publications is observed after ~2020, I hypothesise due to COVID-19 and the (relative) slowdown in the industry. Notably, filings have not yet recovered to the heights of pre-2020, although I expect we will see continued growth in the coming years go on to exceed pre-2020 levels.

In terms of innovation areas, the report considers four key technology areas:

- Sustainable propulsion (e.g. hydrogen fuel cells, electric turbines);

- Automation and circularity (e.g. robotics, additive manufacture, recycling);

- Communication and security (e.g. navigation, 5G, cybersecurity); and

- Human-machine interface (e.g. touch displays, facial recognition, virtual reality).

As shown in Figure 1 above (right), communication and security is by far the largest contributor to innovation activity, in air transportation, of the four areas. This is unsurprising given that communication and security includes technologies such as navigation, connectivity and cyber security. Sustainable propulsion follows in second place, with automation and circularity, and human-machine interface, technologies in third and fourth place respectively. The make-up of these four contributing technology areas is explored in more detail in Figure 4 below.

Patent family publication trends in air transportation in 2000-2023 by inventor location

Another interesting representation provided by the report is copied below as Figure 2. In Figure 2 the relative proportion of innovation in the four focussed-upon technology areas is broken down by inventor location. Various trends emerge such as, for example, a focus of Belgian and UK innovation in the sustainable propulsion area. Some territories are also observed to place a significant emphasis on communication and security technologies over and above any other technology areas, such as in China, Israel and the Russian Federation in particular. Given other trends which emerge, which will be explored below, a comparatively small proportion of sustainable propulsion effort in China is a surprising result of Figure 2.

Compound Annual Growth Rate (CAGR) of patent family publications by top 25 patent owners in air transportation in 2018-2023

Figure 3, below, illustrates significant patent filing growth from some of the largest Chinese patent filers in the air transportation field during the period 2018-2023. In contrast, some of the very largest, and most renowned, businesses in the field, such as Rolls Royce, Boeing and General Electric, have seen a significant reduction in the CAGR of patent filings. As mentioned previously, the aftereffects of the COVID-19 pandemic likely play a role here, particularly for the businesses with reduced CAGR. The growth in filings in China may be attributable to general trends in competing aviation technologies out of China in recent years, challenging some of the industry’s historical aviation powerhouses.

Patent landscape of air transportation patent families by technology areas and territory in 2000-2023

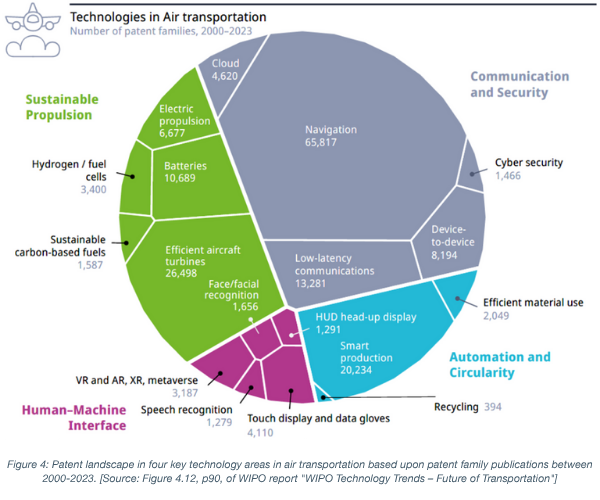

Figure 4 below shows the breakdown of the four key technology areas (communication and security, sustainable propulsion, automation and circularity and human-machine interface) in more detail. Stepping through each of the key areas in turn:

- Sustainable propulsion technologies (~41k total) are dominated by efficient aircraft turbines (~27k families), with battery (~11k) and electric propulsion technologies (~7k) providing a significant contribution. Hydrogen fuel cells and sustainable carbon-based fuels jointly contribute ~5k patent family publications;

- Automation and circularity (~22k total) is, for the most part, constituted by smart production technologies (~20k). Efficient material use technologies contribute ~2k family publications, with recycling technologies providing a (to me) surprisingly low proportion of <400 publications;

- Communication and security technologies (~82k total) dominate the overall publication numbers, with navigation providing a significant proportion (~67k) of the overall patent families in the field. Low-latency communications (~13k), device-to-device (~8k) and cloud (~5k) technologies contribute significantly, also. Cyber security is the smallest proportion of communication and security technologies at ~1.5k publications; and

- Human-machine interface (~9k total) technologies are constituted by more of a spread of technologies including: touch display and data gloves (~4k), VR and AR (inc XR and the metaverse) (~3k) and facial recognition (~1.6k), and heads-up-display technologies (1.3k).

It is surprising to see quite the extent to which navigation technologies have outpaced all other areas. I also expected cyber security technologies may constitute a greater proportion of the communication and security technologies. Sustainable propulsion technologies are, altogether, lower in number than I expected, particularly in light of the significant communication and security contribution. Smart production constituting a significant proportion of the automation and circularity technology area is not entirely surprising, but the comparatively low number of recycling patent families is a surprise. That said, there may well be overlap between recycling and efficient material use technologies.

Figure 5 below shows a breakdown of the four key technology areas based upon inventor location. Figure 5 thus illustrates territories particularly active in innovation for a given area. Other data shown in Figure 5 includes high growth (CAGR) locations for the different technology areas, and a specialised location index (a WIPO metric) indicating territories which are particularly specialist in certain technology areas. Lastly, the top patent owners in each of the different technology areas are listed.

Stepping through some observations from the Figure 5 data above:

- China and the US emerge as significant leaders for inventor locations across the four technology areas in air transportation, with notable mentions to France for sustainable propulsion technologies, and Japan for automation and circularity, and communication and security, technologies;

- China emerges as a high growth location across all technology areas, with a seeming CAGR reduction across the board for human-machine interface technologies (given even China’s negative CAGR). The Republic of Korea, and Italy, emerge as high growth location leaders for automation and circularity, and communication and security, technologies respectively;

- France is a clear leader across all technology areas in terms of specialism (‘relative specialism index [RSI])’. The RSI is a WIPO metric indicative of a territory’s ‘share’ of patenting activity in a particular field, taking into account the territory’s overall level of patenting activity. As noted in the report, given France’s significant aerospace industry (Airbus, Safran), this result is not surprising. The UK emerges as a significant contributor in the sustainable propulsion field, more specialised than even the US; and

- Boeing is the most prolific patenting entity in the automation and circularity, and communication and security, fields. RTX, formerly Raytheon Technologies Corporation, is the largest owner of sustainable propulsion technologies patents, with General Electric and Safran following. The numbers of sustainable propulsion technology patents owned by the largest filers are far higher than those of the communication and security fields, despite the number of sustainable technology patent families being lower. This suggests a greater spread of patent ownership for communication and security technologies, in contrast to a more ‘concentrated’ ownership of sustainable propulsion technologies patents.

Technology focus: urban air mobility

One air transportation area which has seen significant recent development is that of urban air mobility. That is, the use of personal, or low capacity, aircraft in urban environments.

Figure 6 below shows the trend in (generally) increasing publication numbers of both patent families and scientific publications in the field during the period 2000-2023. The report notes an increase in global patent family publications from 67 in 2014 to almost 400 in 2023. That said, these numbers remain relatively low, perhaps indicative of caution in the field given the significant infrastructure, regulatory and other developments needed for the technology to become mainstream. There have also been an unfortunate number of high profile urban air mobility firms facing bankruptcy as of late (Lilium, Volocopter), suggesting the field remains a commercially challenging one.

How does innovation in air transportation compare to other transport modes?

A surprising conclusion highlighted by the report is that air transportation, where applicants are typically prolific in the filing of patents, places in a comfortable last position when compared to counterpart land, sea and space transport modes. This is specifically with regard to the four key technology areas discussed in detail elsewhere in this article, as evidenced by the 2018-2023 patent publication data set out below in Figure 6.

As already mentioned, I expect COVID-19 has had a role to play in the air transportation innovation trends since ~2019. It is perhaps not surprising that significant growth has been observed in the space sector, but the rates of growth in land and sea technologies are a pleasant surprise. Across the board, communication and security, and sustainable propulsion, areas rank highly, but automation and circularity is, surprisingly, the highest contributor for land transport modes.

Closing remarks and predictions for the future

Whilst patent filing numbers are (generally) significantly higher than ~10 years ago, air transportation in particular has seen recent contractions in growth rates. This is particularly the case for the (historically) largest patent filers in the industry, some of whom have seen filing numbers reduced by ~25% and more. Some of the highest growth rates are observed from Chinese entities, as global competition continues to drive innovation.

Innovation remains to have a territorial bias, with, for example, arguably more of a European focus for sustainable propulsion technologies, with other regions focussing more on other areas (such as communication and security).

The number of published patent families directed to navigation technologies far exceeds any comparable technology area in air transportation. The number of navigation-linked patent families published exceeds the total number of sustainable propulsion families in air transportation.

When inventor locations are considered, China and the US are the most prolific territories for air transportation innovation, with a significant contribution from France also.

My predictions for air transportation innovation? I expect continued growth in sustainable propulsion in particular. I expect we will continue to see the highest growth rates from Chinese applicants. Finally, I expect continued, cautious growth around urban air mobility (likely with continued commercial difficulties for some firms, at least in the short term).

One thing we can be sure of? Businesses operating in the air transportation field will continue to protect their most valuable innovations by way of patent applications and other forms of registered intellectual property (e.g. design registrations, trade marks etc.).

Please do not hesitate to get in touch should you have any intellectual property queries relating to the air transportation field or any other technology area.

/Passle/6130aaa9400fb30e400b709a/SearchServiceImages/2026-03-09-14-56-41-628-69aedfa9bd4c920e6dd2a717.jpg)

/Passle/6130aaa9400fb30e400b709a/SearchServiceImages/2026-03-06-21-46-38-285-69ab4b3e33137c4539672718.jpg)

/Passle/6130aaa9400fb30e400b709a/SearchServiceImages/2026-03-06-21-19-43-810-69ab44ef33137c4539671856.jpg)