Introduction

A 2024 peer-reviewed study (here) surveyed 300 healthcare professionals’ (HCPs) across six countries to understand barriers and opportunities in diagnostic testing and antimicrobial stewardship (AMS). AMS is a systematic approach to support clinicians in prescribing and administering antimicrobials according to evidence‑based guidelines.

The study found that economic constraints—insufficient investment, limited resources, and patient or institutional costs—were the primary obstacles to effective diagnostic utilisation. Additional challenges included slow test turnaround times, high antimicrobial resistance (AMR) burden, and gaps in education and guidelines. Notably, most respondents agreed that improved diagnostics reduce AMR (70.3%) and improve patient outcomes (81.0%).

Governments frequently view the costs of diagnostic testing as outweighing its benefits, resulting in limited advocacy for its essential role in healthcare. Nevertheless, in a recent report from the Office of Health Economics (OHE) (here), it was argued that diagnostics are fundamental to antimicrobial stewardship and the fight against AMR. The authors identified a new value framework, they termed STRIDES, which serves to identify the real value diagnostics can bring to tackling AMR and avoiding antimicrobial misuse.

Although the OHE report is too recent in terms of observing any impact it may have, we had not previously looked at the patent filing statistics relating to diagnostic technologies designed to address AMR and AMS. As such, we decided to explore this, in order to complement the related analysis we have been conducting in relation to antimicrobial and vaccine development and to see what trends, if any, we could observe in respect of diagnostic patent filings directed towards combatting AMR.

Methodology

We developed a targeted search strategy to identify diagnostics that aid bacterial infection diagnosis and, where applicable, facilitate therapeutic decision‑making through antimicrobial susceptibility testing. Background research reviewed academic literature and online sources to map key terminology. Recurring terms were curated into keywords and combined with appropriate IPC classifications. Searches were conducted using the Derwent Innovation patent database to obtain a focused and comprehensive set of results capable of revealing trends in diagnostic innovation for AMR.

For analysis, we counted published patent families since 2015, rather than individual applications, as this more accurately reflects an applicant’s intent to secure protection for an invention across jurisdictions.

Results: IPC classification

Figure 1 shows the top 10 IPC classifications identified from our analysis. DNA/RNA analysis is the most prevalent area, perhaps due to the relative speed of detection. It is well recognised that being able to discern the type of infection as quickly as possible is of particular importance, as it enables appropriate therapeutic intervention to be administered rapidly. One AMS concern is that too often antibiotics, particularly broad-spectrum antibiotics, are simply being administered before any diagnostic testing has been carried out, or before results become available. Clinicians often prioritize immediate treatment over awaiting diagnostic results, underscoring the need for rapid testing solutions.

| IPC Code | Brief Summary | # Patent Families |

| C12Q 1/18 | Measuring or testing processes involving nucleic acids (DNA/RNA) | 151 |

| B01L 3/00 | Laboratory apparatus for handling liquids (pipettes, dispensers) | 95 |

| C12Q 1/04 | Measuring or testing processes involving microorganisms | 85 |

| C12Q 1/689 | Specific nucleic acid detection methods (e.g., PCR-based assays) | 65 |

| C12M 1/34 | Apparatus for culturing cells or tissues | 63 |

| C12M 1/00 | General apparatus for microbiological or enzymatic processes | 43 |

| G01N 21/64 | Investigating materials using optical means (e.g., fluorescence) | 35 |

| G01N 33/569 | Analysis of biological material (e.g., immunoassays) | 34 |

| C12Q 1/02 | Measuring or testing processes involving enzymes | 31 |

| A61P 3/04 | Medicinal preparations for metabolic disorders (e.g., diabetes) | 28 |

Figure 1. Top 10 IPC classifications by number of INPADOC patent families where assignees have published patents

While DNA/RNA testing can serve to identify the causative agent of an infection (e.g. a bacterium or virus), it does not necessarily facilitate identifying which antibiotic would be appropriate to administer when a bacterial infection is diagnosed. Here it is necessary to conduct an antibiotic susceptibility test, which historically is time-consuming. It is notable therefore that a number of the top 10 IPC classification codes are directed to method and apparatus looking specifically at the causative agent and a closer look at the patents revealed by our research, shows that a significant proportion of the identified patent applications are directed to antibiotic susceptibility testing. Antibiotic susceptibility testing allows a clinician to make an informed decision in terms of antibiotic use and is important for AMS and the combat against AMR.

Patent Filing Trends

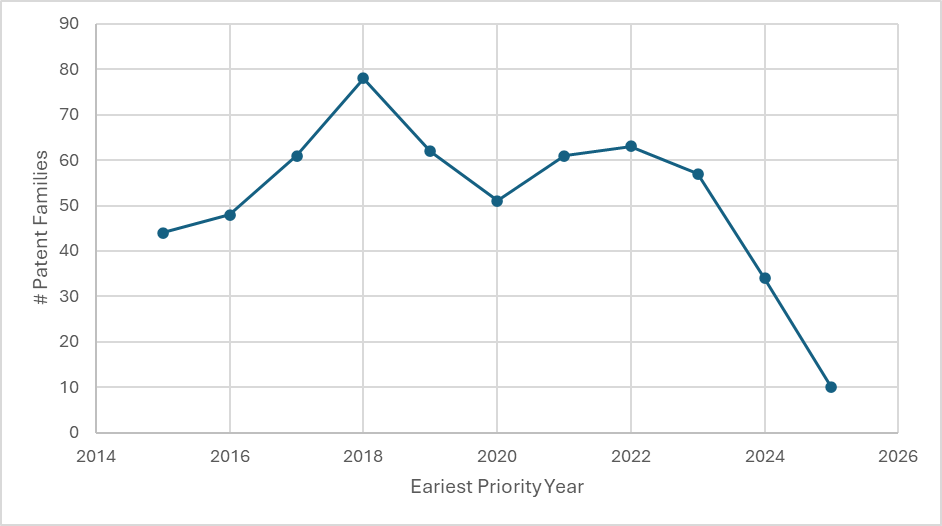

As we had found previously (here), when looking at the number of antibiotic-related patent families that had been filed between 2015 and 2024, there was an initial increase in patent filings until 2018, followed by a decrease in 2019 and 2020, which coincided with the COVID pandemic (see Figure 2). During the pandemic, there was a clear focus on COVID diagnostic test development and the data clearly shows a reduction in patent filings directed towards bacterial infection diagnostic innovation. The global burden of COVID-19 redirected diagnostic innovation almost exclusively toward COVID testing, sidelining bacterial diagnostics. Industry data confirms that diagnostic companies rapidly redirected resources to COVID test development during the pandemic.

However, following the pandemic, is there a repositioning and more patent applications being filed in respect of bacterial infection detection?

Figure 2. Published patent families relating to bacterial infection diagnostics (2015-2025)

Due to an 18-month delay in patent publication, the results from 2024 and 2025 are incomplete and should be interpreted with caution. Nevertheless, following the dip observed in 2019/2020, bacterial infection diagnostic patent filings have recovered only modestly and plateau. This contrasts to what we observed with respect to antimicrobial-related filings, which showed only a slight decrease in numbers following the pandemic. The evidence suggests that diagnostic innovators may still be prioritising and investing in viral detection over bacterial diagnostics. A comparative analysis of viral diagnostic patenting is recommended to validate this hypothesis and inform strategic investment decisions.

Accurate identification of viral infections supports AMS by preventing inappropriate antibiotic use. Nonetheless, identifying bacterial infections and their antibiotic susceptibilities is even more critical for stewardship, guiding timely and effective therapy while limiting resistance selection.

Another potential concern, as observed from Figure 2, is the total number of patent filings. Our data shows that over the 10 years, the total number of bacterial infection-focussed diagnostic patent applications is well over ten-fold less than the number of antimicrobial patent applications filed over essentially the same period. Combined with the stagnant filing trend, this indicates a troubling lack of focus on bacterial diagnostic R&D—despite clear evidence of its critical role in combating AMR and supporting stewardship.

The patent filing data certainly seems to echo and reinforce that, without suitable incentives and/or reimbursement, many innovators simply do not view the field of microbial diagnostics to be worthy of their attention.

Assignee Landscape

Figure 3 lists the top 15 patent assignees in microbial diagnostics. The landscape comprises a mix of specialist companies, large multinationals, and universities/research institutions. Selux Diagnostics leads by number of filings. Selux is a company specifically focussed on infectious disease diagnostics. Worryingly, the EP register (the patent register identifying patent applications filed at the European patent office) shows many of their patent applications to be withdrawn. Of the other specialist infectious disease companies: Curetis was acquired by OpGen, Inc. in 2019 although their Unyvero system is on the market; and Q-linea has reported organisational and leadership changes, while its share price is at a fraction of what it was 5 years ago. This suggests that specialist bacterial diagnostics companies are finding the commercial market difficult to navigate.

| Assignee | Patent Families |

| SELUX DIAGNOSTICS INC | 18 |

| BECTON DICKINSON AND CO. | 9 |

| KONINKLIJKE PHILIPS N.V. | 8 |

| CHINESE ACADEMY OF SCIENCE | 7 |

| UNIVERSITY OF CALIFORNIA | 7 |

| ARIZONA STATE UNIVERSITY | 6 |

| BIOMERIEUX SA | 6 |

| CURETIS GMBH | 6 |

| Q-LINEA AB | 6 |

| TIANJIN GENSKEY MEDICAL TECHNOLOGY CO | 6 |

| CALIFORNIA INSTITUTE OF TECHNOLOGY | 5 |

| CHARLES STARK DRAPER LABORATORY INC | 5 |

| MASSACHUSETTS INSTITUTE OF TECHNOLOGY | 5 |

| PENNSYLVANIA STATE UNIVERSITY | 5 |

| PROCTER & GAMBLE CO. | 5 |

Figure 3. Top assignees in microbial diagnostics (by patent families)

For large multinationals (e.g., Becton Dickinson, Philips, bioMérieux), filings in this specific area constitute a small fraction of their overall patent portfolios, suggesting constrained strategic emphasis on bacterial diagnostics.

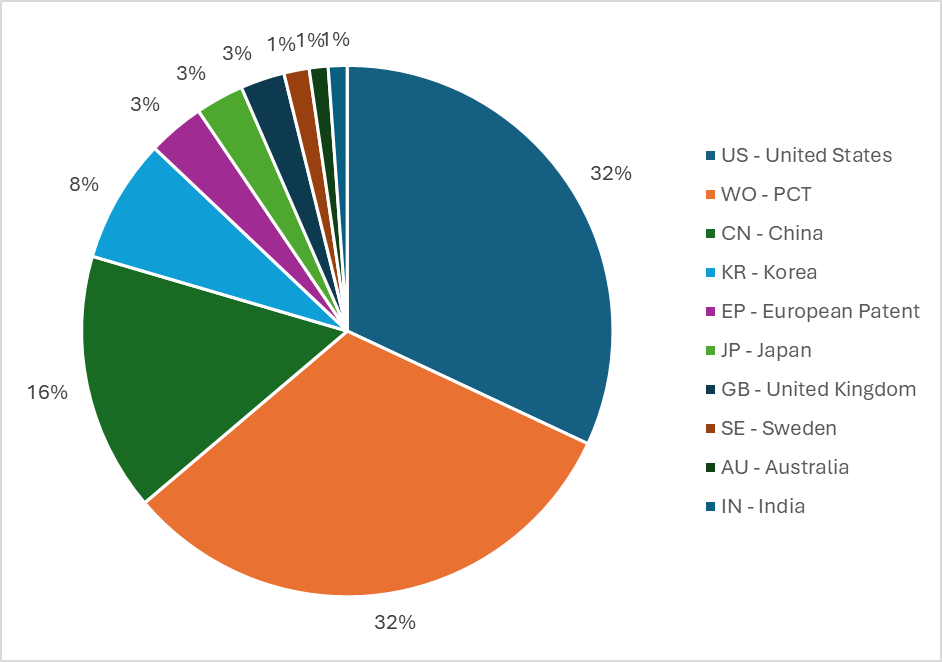

First filing Landscape

Figure 4 identifies where the priority patent applications are being filed. The data shows most initial patent filings are being made in the US and the filings in China being approximately half of this. Comparing this to the latest data published by the World Intellectual Property Organisation (WIPO) (here), identifying the total number of patent filings worldwide, it can be seen that proportionally (total patent filings in all areas vs total patent filings in the microbial diagnostics field) the US is filing a lot more and China a lot less. However, further data analysis shows that in the US there was a peak in filings in 2018 and a decline since then. Likewise, proportionally, fewer filings are being made in Europe and Japan, as compared to total patent applications.

Figure 4 The combined share of priority microbial diagnostic patent filings

This mirrors the patent filing number data, enforcing the view that lack of incentives and/or appropriate reimbursement is discouraging research and development in this field.

Conclusions

Our analysis underscores a critical gap in microbial diagnostic innovation, despite its recognized importance for AMS and combating AMR. Persistent barriers—such as insufficient incentives and inadequate reimbursement—continue to suppress research and patent activity in this field.

To reverse this trend, coordinated action is essential. Policymakers should prioritize funding and reimbursement frameworks that make diagnostic development commercially viable. Clinicians and healthcare leaders must advocate for the integration of rapid diagnostics into standard care pathways, reinforcing their role in preserving antibiotic efficacy.

Without decisive intervention, the current stagnation risks undermining global efforts to control AMR. Conversely, targeted investment and policy reform can accelerate innovation, expand access to advanced diagnostics, and safeguard the effectiveness of antimicrobials for future generations.

Diagnostics are critical in the fight against AMR, ensuring patients who need antimicrobials receive them and unnecessary antimicrobial use is minimised.

/Passle/6130aaa9400fb30e400b709a/SearchServiceImages/2026-02-20-11-36-52-281-699847546e72c93143eac060.jpg)

/Passle/6130aaa9400fb30e400b709a/SearchServiceImages/2026-02-20-12-16-52-510-699850b43c0e09083e8a91e9.jpg)

/Passle/6130aaa9400fb30e400b709a/SearchServiceImages/2026-02-17-11-02-00-908-69944aa841083f2011e0faad.jpg)